Beyond the hype: NFTs, digital art and copyright

An Article by Tobias Lantwin

$69m for a .jpeg? That is, for a .jpeg that anyone can right click and download? Why would anyone pay that much money for… well, what, exactly? NFTs (Non-Fungible Tokens) raise many questions, not only from a technical perspective, but also with respect to copyright. Tobias Lantwin takes a closer look.

Non-Fungible Tokens (NFTs) have just recently made headlines in the art world for the remarkable amounts of money they generated in the realms of digital art. From the “Nyan Cat”, “Disaster Girl” and “Charlie bit my finger” memes (selling for $590’000, $500’000 and £538,000, respectively), the first tweet of Twitter’s own Jack Dorsey (selling for $2’915’835.47) to an invisible sculpture of Italian artist Salvatore Garau (selling for roughly $18’200) and Croatian tennis player Oleksandra Oliynykova tokenizing parts of her own right arm (selling for $ 5’000) – NFTs can represent all kinds of contents. Even this blog entry could be turned into an NFT. However, arguably the most astonishing price tag came with a piece of digital art by artist Beeple named “Everydays: The first 5000 days”, an NFT of which sold for $69’346’250 through an auction at Christie’s in early March 2021.

So, what is an NFT, then? Or in other words: what was bought that was worth $69’346’250? NFTs, broadly speaking, concern contents that are connected to a blockchain (usually the Ethereum blockchain) through a token, i.e., a set of data with a unique ID. That token “represents” the digital artwork. This token is the NFT which can be bought and sold. There is no limit to what NFTs can represent. They can represent digital images, films, audio, or something entirely intangible (such as an invisible sculpture). What makes NFTs special is that unlike fungible tokens (e.g., the Bitcoin cryptocurrency or many other cryptocurrencies), Non-Fungible Tokens are not interchangeable. Hence, they are unique in that there is unique content (e.g., a piece of digital art) to which a specific and unique token in a blockchain relates to which cannot be exchanged or replaced by any other token, as is the case with Bitcoin, for example.

One of the original ideas behind NFTs was to solve the problem for artists that, once they publish their digital artwork online, virtually anyone with an internet connection could right-click and save that piece of art and copy, alter or republish it as they please without giving credit to its original author. By allowing artists to create (or “mint”) an NFT inalterably relating to one of their artworks, NFTs are supposed to proof the artwork’s provenance, i.e., its ownership history. So the idea is that when a work is created, an NFT is created at the same time to prove the authenticity and provenance of the work and to document any resale accordingly. Since any transaction relating to the NFT is documented in the blockchain with a high degree of security against manipulation, anyone can view the current and former ownership of the respective NFT. Not seldom is the aim of “regaining control” over digital art cited as one of the main motivations for artists to mint NFTs.

In addition, because any NFT of an artwork is always ‘unique’ in nature (since the token itself is unique), NFTs are often credited to have introduced the concept of scarcity to digital art. Since the artists can decide to mint one or even a number of unique NFTs relating to one of their artworks, NFTs promise to transfer the underlying concept behind collectibles (such as baseball cards) into the digital realm. The CryptoKitties NFTs, which allow its users to create, sell, buy and thereby collect unique sets of virtual cats, are a good example.

But how is this a copyright issue? The inherent problem with NFTs is that not only the artist can mint an NFT of his or her artwork. In fact, essentially anyone can mint an NFT of whatever content imaginable without any need to prove authorship or ownership of licensing rights. It so happened that copycats have successfully started using artworks they do not own to mint NFTs and sell them, much to the dismay of the actual authors. Given the considerable amounts of money artists make with the sale of NFTs (and often even at least 10% with each subsequent sale), many artists understandably feel violated in their rights and claim copyright infringements.

So, does the minting and selling of NFTs of other people’s art amount to a copyright infringement? The answer to this question requires a closer look at what actually happens from a technical perspective when an NFT is minted and sold to a new owner and, in particular, what is actually being sold when NFTs are transferred (the following explanations are based on great in-depth explanations available here). This is where many news reports’ apparent misconceptions begin. One thing is certain: usually, it is not the digital artwork itself that is being sold.

There are many ways to mint digital artworks into NFTs (a good overview over the different methods is provided here). Arguably the most common way to create NFTs in practice is to use specialized NFT minting platforms (such as OpenSea, Niftygateway, etc. to name but a few) that provide the technical infrastructure on their websites necessary for minting and selling NFT art. The creator of an NFT could also upload and host the necessary files themselves.

In any case, the first step usually involves the uploading of a piece of digital art of any form. Since files containing digital art are usually too large to upload them onto the limited space on the Ethereum blockchain (which also makes uploading quite expensive), they are usually uploaded elsewhere. They are uploaded either on one of the many designated platforms or on any other hosting space (like the commonly used “Interplanetary File System”, or “IPFS”, a decentralized filesharing system on the darknet which was used for the Beeple artwork).

Then, a cryptographic hashing algorithm is used to create an individual hash of the file containing the artwork. A strong hashing algorithm creates a signature (or “fingerprint”) of the file consisting of a sequence of letters and numbers that uniquely identifies that file and that file only, since – in theory – no other file can have the same hash. Changing even a mere pixel of an image would immediately lead to an entirely different hash code. Hence, this hash can identify the “original” image.

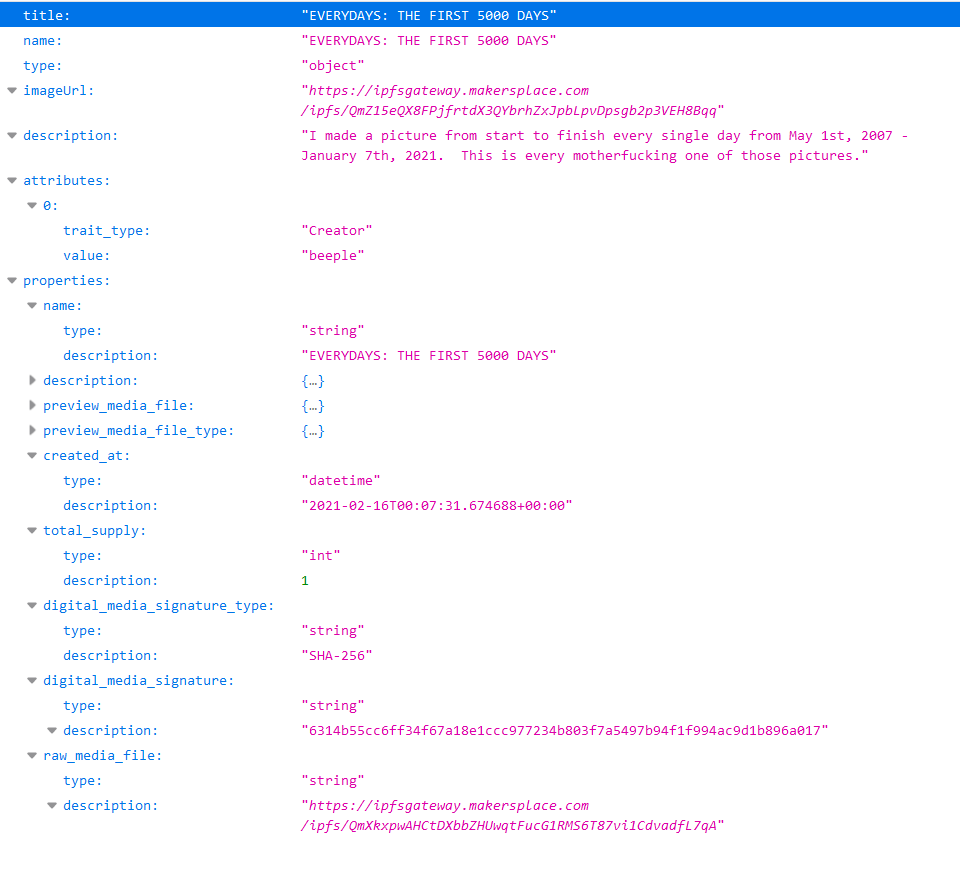

Example: This is the 256-bit hexadecimal hash value for Beeple’s artwork:

6314b55cc6ff34f67a18e1ccc977234b803f7a5497b94f1f994ac9d1b896a017

Once this hash is created, an accompanying metadata file for the artwork is created. This file in the .JSON-format contains metadata to the artwork, such as the name and title of the artwork, the author’s name, a description and other information. Most importantly, however, the metadata file also contains the hash of the artwork file and an exact hyperlink to the hosting space that hosts the artwork file. Finally, this .JSON metadata file is also uploaded to the web or darknet and hashed.

For the creation of an NFT, the creators rely on Smart Contracts that are run on the Ethereum blockchain. Smart Contracts are not contracts in the legal sense but written code that executes commands under preset conditions. To mint an NFT, creators use the different functions programmed into the Smart Contract to create a new token and insert both the hash of the metadata file and an exact hyperlink to the hosting space that hosts the metadata file. In addition, the creator is assigned as the “creator” and “owner” of the NFT. Finally, the token is assigned an ID. The token that is created by these means is what is called the “Non-Fungible Token”. This is what is actually written into the blockchain.

In the case of Beeple’s NFT, for example, the “MakersTokenV2” Smart Contract was used. The NFT’s ID is #40913 (i.e., this token is the 40’913th token created using this Smart Contract) and the “creator” hash value corresponds with Beeple’s – or, to be more precise: it corresponds with Beeple’s wallet address that he used to create the NFT on the blockchain.

#40913

• creator:

0xc6b0562605d35ee710138402b878ffe6f2e23807

• MetadataPath:

QmPAg1mjxcEQPPtqsLoEcauVedaeMH81WXDPvPx3VC5zUz

• tokenURl:

ipfs://ipfs/QmPAg1mjxcEQPPtqsLoEcauVedaeMH81WXDPvPx3VC5zUz

Hence, the NFT is essentially a chain of references: The NFT includes the hash and hyperlink to the metadata file, which in turn includes the hash and hyperlink to the actual image that the NFT represents (i.e., hash → metadata → hash → digital art). Since there is a chain of hashes that cannot be broken or interrupted without it resulting in an alteration of the respective hashes, the references are pretty much save from any manipulation.

In order to sell the NFT, the creator executes the Smart Contract’s transfer() method (who, as long as he or she does not lose his or her password to the respective wallet, is the only person that can initiate this). Executing this method will change the current value at “owner” to that of another wallet address, i.e., the wallet of the buyer. This, in essence, is what the buyer gets. The buyer is placed in the “owner” role in the respective Smart Contract’s instance. Or, more precisely, the buyer gets the ability to now change the “owner” value to another prospective buyer.

Therefore, contrary to what many media reports seem to suggest (here, here or here, for instance), the buyer of an NFT does not buy “the digital artwork” itself. He or she does not get any exclusive rights or licensing rights. There is the possibility to conclude an additional licensing agreement (as is the case with the CryptoKitties NFTs), but this is all but the norm. Regularly, the new owner of the NFT can basically not claim any ownership over the artwork. Instead, the NFT merely ‘represents’ the artwork. This becomes evidently clear in cases where NFTs are minted for other things than images, such as the Croatian tennis player’s arm. There can hardly exist any rights relating to another person’s body parts.

In fact, the only thing the buyer gets is the ability to change the NFT’s (and not the artwork’s) ownership status. The NFT does not contain much more than references to a metadata file which in turn contains another reference to the actual file where he or she (or basically anyone else, since the links are visible in the blockchain) can view the respective artwork. Hence, the buyer is always at risk that files containing the artwork and/or the metadata are deleted from the servers (which, incidentally, has already started to happen).

A real-world analogy may help to further understand what is actually happening. A comparison often made is the following: Imagine you view the Mona Lisa at the Louvre. Next to it, there is Leonardo da Vinci (who, for the sake of making the comparison, shall still be alive). He hands you a piece of paper that contains a description (or ‘metadata’) of the Mona Lisa’s title, its painter, where to find it in the Louvre and his signature to prove that he wrote this receipt. This receipt is then put in an envelope (which could serve as an equivalent to the NFT), which in turn is put into a locker, the contents of which are visible for anyone to see (which could serve as an equivalent to the blockchain). By buying the receipt (and not the artwork!) you have the ability to store the envelope with the receipt in your locker that only you have the key for. That puts you in the position to transfer that envelope to the locker of anyone else that is willing to pay a price you accept. Until that happens, the envelope is under your control – or, you “own” it: the NFT. Whether you also own the artwork itself that the NFT represents is an entirely different question that simply buying an NFT regularly does not answer.

To sum up: The NFT is not the artwork itself. The NFT merely “represents” the artwork by referencing it through various chains of references. In addition, the digital artwork usually stays online for anyone to see and download, as is the case with Beeple’s artwork, the NFT of which was bought for $ 69m. What the buyer got was simply a token created by Beeple that verified the artwork’s provenance in the blockchain and that may serve to prove to the buyer that, if he or she views or downloads the respective artwork, he or she does not simply get “any copy” of that artwork, but that this copy is “the one” copy that makes it special. What could be described as the “good feeling” of owning “something special” certainly is one of the main factors – apart from the ability to help artists make money off of their art, possible money laundering activities and a general crypto-hype at the moment – that may explain the frenzy behind NFTs. Apart from this, it is hard to conceive that there is any real value in owning an NFT.

Not only does the fact that the buyer usually does not even get any rights relating to the digital artwork itself call into question the validity of the comparison to collectibles. What is more, one of the main characteristics of NFTs that have promised to revolutionize the art world – which is the possibility to verify an artwork’s provenance – is substantially limited. Since anyone can mint an NFT of anything, even of something they do not own (after all, there are various NFTs of da Vinci’s Mona Lisa here and here), there is no certainty in an artwork’s provenance at all, unless the NFT is prominently sold (as was the case with Beeple’s NFT at Christie’s, for instance). That is to say, there is no viable way for lesser-known artists to effectively protect their digital art from being “stolen” by copycats and being minted into NFTs.

This leads back to the original question: can copyright do anything at all to at least respond to this retroactively? The sale of the NFT, as has already been noted, does not change anything about the state of a possible copyright that may apply to the underlying artwork, since – again – it is not the image or corresponding licensing rights that are being sold. This leads some commentators (here, here and here) to believe that minting and selling NFTs are largely irrelevant from a copyright perspective.

And indeed, there is no merit to assume that minting an NFT amounts to a copyright infringement. At first glance, it would be conceivable to regard the minting of an NFT as an infringement of the right of reproduction of the underlying work (as set out in Article 2 InfoSoc Directive). The concept of reproduction is interpreted very broadly and also includes physical fixations that make the work perceptible to the human senses both by direct and indirect means which require further steps to make the work directly perceptible. Thus, the production of printing blocks, negatives or matrices also constitutes a “reproduction” within the meaning of Article 2 InfoSoc Directive. When an NFT is minted, the digital artwork is hashed, i.e., transformed into a written hash code. However, since the cryptographic hash code cannot be converted back into the work but can only authenticate a certain work by matching its hash code, the artwork cannot be made perceptible to the human senses with the help of that code. The code itself does not allow any conclusion as to whether it refers to an image, a video, an audio file, etc. Thus, an infringement of the right of reproduction cannot be seen in the process of minting an NFT.

But what about the metadata file? The metadata files of NFTs often include hyperlinks to the actual artwork the NFT is supposed to represent. By clicking that link, the artwork is available for viewing and downloading. However, the majority of commentators and legal scholars do not consider the setting of a hyperlink to be an infringement of the right of making available to the public (Article 3 InfoSoc Directive).

This may still leave a possible violation of copyright moral rights (in particular, the right of attribution of authorship), as some commentators have suggested. When copycats mint other people’s works, a violation of this right does not seem entirely implausible. Minting an NFT leads to an entry in the blockchain that assigns its creator as “creator” and (current) “owner” – and not the author of the underlying work of art. However, this attribution only refers to the current state of the NFT and not to the underlying artwork. Therefore, it is accurate that the creator of the NFT is specified as “creator” and – as long as he or she does not sell the NFT – as its current “owner”. This is in fact not a statement about the authorship of the work of art, even though it may be partially misunderstood as such. This arguably rules out a violation of moral rights as well.

So, are NFTs not a copyright issue at all? No, because in the context of minting NFTs of other people’s art, copyright is still violated in most cases. That is because in order to mint an NFT, the underlying artwork or a copy of it usually needs to be uploaded on a hosting or minting platform, which constitutes an infringement of the right to reproduction pursuant to Article 2 InfoSoc Directive. In addition, the artwork is usually made available to the public and/or the buyer to view and download. Often, a preview to the artwork is also made available. Absent appropriate justification, both of these uses also violate the right of making available to the public pursuant to Article 3 InfoSoc Directive. However, these types of uses are not at all unique to NFTs but concern common cases of copyright infringements in the internet.

Finally, NFTs could pose difficulties from a licensing perspective, if an NFT is to be minted on a work for which exclusive licenses have been granted for all known and unknown types of use. It seems conceivable that minting an NFT could qualify as an (unknown) type of use, limiting the possibilities of the licensor to mint NFTs.

NFTs certainly are another episode to a series of crypto-hypes, an irritating one at best. Not only can NFTs not solve the broader underlying issue for artists that they do not have any meaningful protection for their digital art once they publish it online. On the contrary, the trading of NFTs apparently tends to create even greater incentives for intellectual property theft. Since NFTs have become a commodity on their own, the trade has become somewhat detached from the underlying digital art. And many buyers do not seem to fully grasp what it is they are buying.

Given the outright catastrophic consequences for the climate that ensue with minting and selling NFTs (for example, one artist’s 1’500-edition NFT consumed 263’538 kWh of energy and emitted 163.49 tonnes of CO2 in less than half a year; an equivalent to an EU resident’s electricity consumption for 77 (!) years or using a laptop for 2500 years), Non-Fungible Tokens form a questionable trend, much rather an irresponsible one. With the trend already on the decline and the first countries having started to prohibit NFTs, it is highly doubtful whether they will really revolutionize the art market.

Tobias Lantwin is a Research Assistant at the Chair of Civil Law and Intellectual Property Law of Prof. Dr. Jan Busche at Heinrich Heine University in Düsseldorf, Germany, and editor at dusIP.